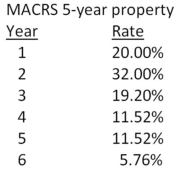

Keyser Petroleum just purchased some equipment at a cost of $67,000.What is the proper methodology for computing the depreciation expense for year 2 if the equipment is classified as 5-year property for MACRS?

A) $67,000 × (1 - 0.20) × 0.32

B) $67,000/(1 - 0.20 - 0.32)

C) $67,000 × (1 + 0.32)

D) $67,000 × (1 - 0.32)

E) $67,000 × 0.32

Correct Answer:

Verified

Q18: The bid price is:

A)an aftertax price.

B)the aftertax

Q19: Which of the following should be included

Q20: The fact that a proposed project is

Q21: The top-down approach to computing the operating

Q24: Which one of the following is a

Q25: Increasing which one of the following will

Q27: The net book value of equipment will:

A)remain

Q28: The operating cash flow of a cost-cutting

Q28: Dan is comparing three machines to determine

Q31: Which one of the following statements is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents