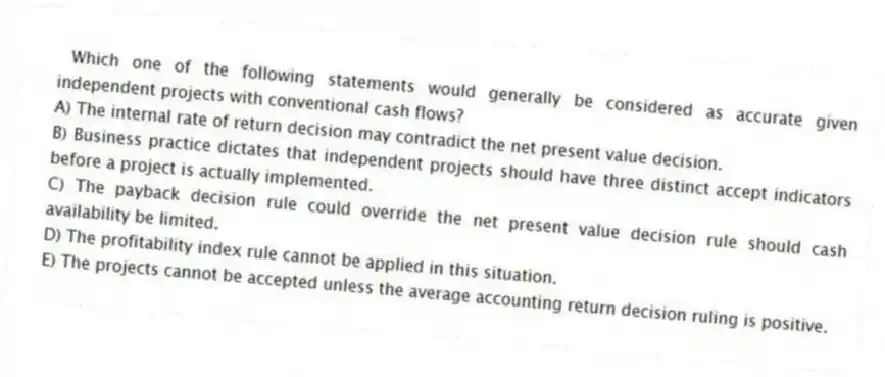

Which one of the following statements would generally be considered as accurate given independent projects with conventional cash flows?

A) The internal rate of return decision may contradict the net present value decision.

B) Business practice dictates that independent projects should have three distinct accept indicators before a project is actually implemented.

C) The payback decision rule could override the net present value decision rule should cash availability be limited.

D) The profitability index rule cannot be applied in this situation.

E) The projects cannot be accepted unless the average accounting return decision ruling is positive.

Correct Answer:

Verified

Q49: Projects A and B are mutually exclusive

Q50: Which one of the following indicates an

Q51: Roger's Meat Market is considering two independent

Q52: A project has a required return of

Q53: Which two methods of project analysis are

Q55: A project has an initial cash outflow

Q56: Isaac has analyzed two mutually exclusive projects

Q57: Western Beef Exporters is considering a project

Q58: Mutually exclusive projects are best defined as

Q59: The present value of an investment's future

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents