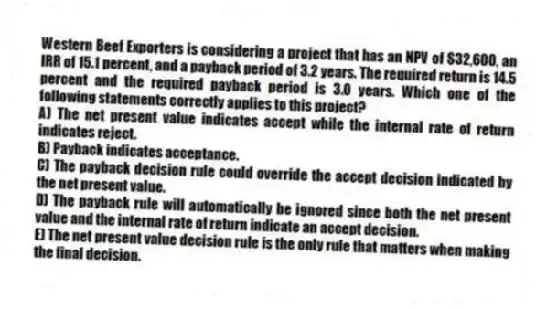

Western Beef Exporters is considering a project that has an NPV of $32,600, an IRR of 15.1 percent, and a payback period of 3.2 years. The required return is 14.5 percent and the required payback period is 3.0 years. Which one of the following statements correctly applies to this project?

A) The net present value indicates accept while the internal rate of return indicates reject.

B) Payback indicates acceptance.

C) The payback decision rule could override the accept decision indicated by the net present value.

D) The payback rule will automatically be ignored since both the net present value and the internal rate of return indicate an accept decision.

E) The net present value decision rule is the only rule that matters when making the final decision.

Correct Answer:

Verified

Q52: A project has a required return of

Q53: Which two methods of project analysis are

Q54: Which one of the following statements would

Q55: A project has an initial cash outflow

Q56: Isaac has analyzed two mutually exclusive projects

Q58: Mutually exclusive projects are best defined as

Q59: The present value of an investment's future

Q60: Kristi wants to start training her most

Q61: It will cost $9,600 to acquire an

Q62: A project has an initial cost of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents