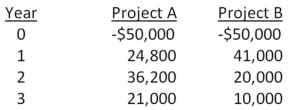

You are considering the following two mutually exclusive projects.The required rate of return is 14.6 percent for project A and 13.8 percent for project B.Which project should you accept and why?

A) project A; because it has the higher required rate of return

B) project A; because its NPV is about $4,900 more than the NPV of project B

C) project B; because it has the largest total cash inflow

D) project B; because it has the largest cash inflow in year one

E) project B; because it has the lower required return

Correct Answer:

Verified

Q35: The internal rate of return is:

A) the

Q40: Which of the following statements related to

Q41: Mutually exclusive projects are best defined as

Q42: The final decision on which one of

Q43: Kristi wants to start training her most

Q45: You are considering a project with conventional

Q46: Which of the following are definite indicators

Q47: A project will produce cash inflows of

Q48: Which two methods of project analysis were

Q49: Which one of the following is the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents