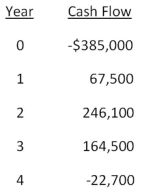

Sheakley Industries is considering expanding its current line of business and has developed the following expected cash flows for the project.Should this project be accepted based on the discounting approach to the modified internal rate of return if the discount rate is 13.4 percent? Why or why not?

A) Yes; The MIRR is 6.50 percent.

B) No; The MIRR is 8.67 percent.

C) Yes; The MIRR is 8.23 percent.

D) No; The MIRR is 6.50 percent.

E) No; The MIRR is 7.59 percent.

Correct Answer:

Verified

Q70: It will cost $6,000 to acquire an

Q71: Alicia is considering adding toys to her

Q72: You are considering an investment with the

Q73: J&J Enterprises is considering an investment that

Q74: Based on the profitability index rule,should a

Q76: Blue Water Systems is analyzing a project

Q77: Day Interiors is considering a project with

Q78: An investment has the following cash flows

Q79: You are considering two independent projects with

Q80: Cool Water Drinks is considering a proposed

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents