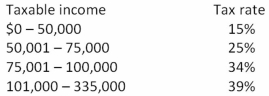

Boyer Enterprises had $200,000 in 2011 taxable income.What is the firm's average tax rate based on the rates shown in the following table?

A) 28.25 percent

B) 30.63 percent

C) 32.48 percent

D) 36.50 percent

E) 39.00 percent

Correct Answer:

Verified

Q64: The 2010 balance sheet of The Beach

Q65: During 2011,RIT Corp.had sales of $565,600.Costs of

Q66: Discuss the difference between book values and

Q67: At the beginning of the year,a firm

Q68: The Lakeside Inn had operating cash flow

Q70: The 2010 balance sheet of Global Tours

Q71: The Blue Bonnet's 2010 balance sheet showed

Q72: Webster World has sales of $12,900,costs of

Q73: Assume you are the financial officer of

Q74: At the beginning of the year,the long-term

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents