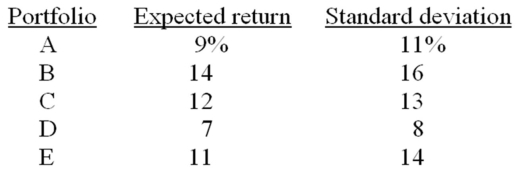

You combine a set of assets using different weights such that you produce the following results.  Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

Which one of these portfolios CANNOT be a Markowitz efficient portfolio?

A) A

B) B

C) C

D) D

E) E

Correct Answer:

Verified

Q45: What is the variance of the returns

Q46: What is the expected return on this

Q47: There is a 30 percent probability that

Q48: What is the variance of the returns

Q49: What is the standard deviation of the

Q51: The risk-free rate is 4.15 percent.What is

Q52: What is the standard deviation of the

Q53: What is the expected return on this

Q54: What is the expected return on this

Q55: What is the expected return on this

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents