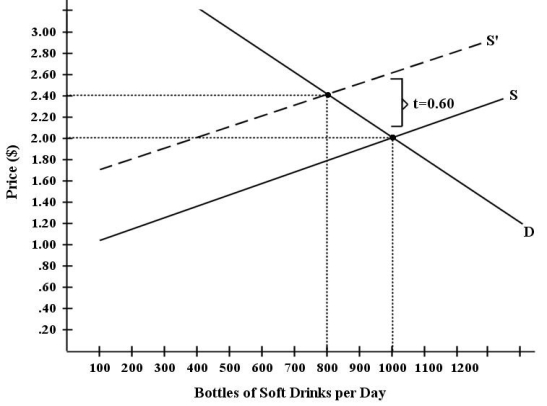

There have been proposals that a tax be imposed on sugar-laden soft drinks in an attempt to reduce their consumption.Assume for simplicity that all bottled soft drinks are the same size.Suppose the initial market equilibrium is P = $2.00 and Q = 1000.  FIGURE 4-4

FIGURE 4-4

-Refer to Figure 4-4.Suppose the government imposes a tax of $0.60 per soft drink purchased.Which of the following statements most accurately describes the economic incidence of this tax?

A) The consumer bears more of the burden because demand is elastic relative to supply.

B) The seller bears more of the burden because supply is inelastic relative to demand.

C) The consumer bears more of the burden because demand is inelastic relative to supply.

D) The seller bears more of the burden because supply is elastic relative to demand.

E) The burden is shared equally between consumer and seller because the slopes of the supply and demand curves are the same.

Correct Answer:

Verified

Q130: Consider the following data for a hypothetical

Q131: If a product's income elasticity of demand

Q132: Consider the following data for a hypothetical

Q133: An increase in income will

A)increase the demand

Q134: If the income elasticity of demand for

Q136: If Vicky's income increases by 8% and

Q137: For a normal good,the quantity demanded

A)responds inversely

Q138: The formula for income elasticity of demand

Q139: Suppose the supply curve for breakfast cereals

Q140: Income elasticity of demand measures the extent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents