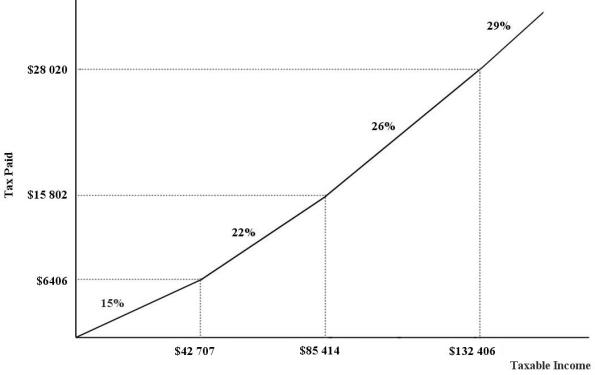

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.An individual with a taxable income of $39 500 will pay ________ in income taxes.

A) $0

B) $6122

C) $5925

D) $6109

E) $8690

Correct Answer:

Verified

Q54: Suppose a Canadian Member of Parliament suggests

Q55: The direct burden of a tax is

A)directly

Q56: The excess burden of a tax

A)is the

Q57: The two main competing goals in the

Q58: Consider two families,each of whom earn total

Q60: An important objective in designing a tax

Q61: Which of the following best describes the

Q62: The diagram below shows supply and demand

Q63: The diagram below shows supply and demand

Q64: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents