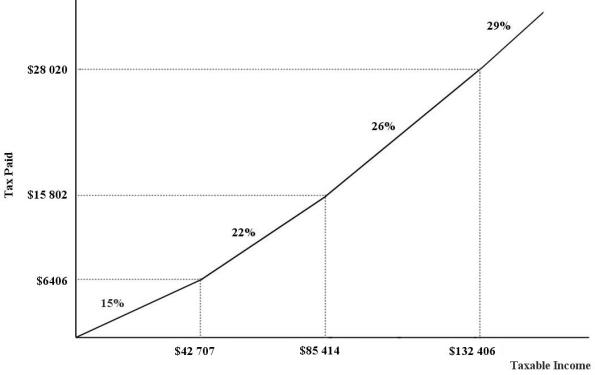

The figure below show a simplified version of the current (2015) Canadian federal income-tax system.The marginal income-tax rates for the four ranges of income are 15%,22%,26%,and 29%,respectively.  FIGURE 18-2

FIGURE 18-2

-Refer to Figure 18-2.This income-tax system can be characterized as

A) cumbersome.

B) fair.

C) progressive.

D) regressive.

E) proportional.

Correct Answer:

Verified

Q43: The figure below show a simplified version

Q44: If there were "horizontal equity" between all

Q45: Which of the following is an example

Q46: When assessing a tax system,"vertical equity" refers

Q47: Suppose a Canadian Member of Parliament suggests

Q49: The figure below show a simplified version

Q50: The Goods and Service Tax (GST)taxes

A)the retail

Q51: Consider the concept of equity in taxation.What

Q52: The concept of vertical equity is derived

Q53: Interest earnings from accumulated savings are subject

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents