FIGURE 18-3

FIGURE 18-3

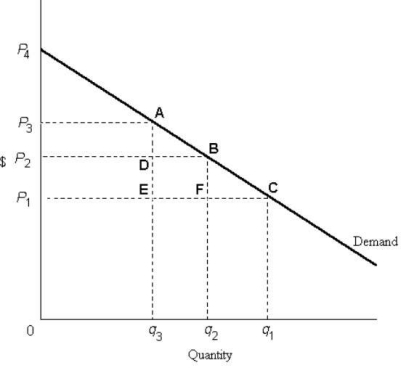

-Refer to Figure 18-3.Suppose that supply is perfectly elastic and the price of this good is initially P1.If an excise tax raises the price from P1 to P2,the direct burden of the tax is

A) the area DEFB.

B) the area P1FBP2.

C) the area P1CBP4.

D) the area BFC.

E) zero.

Correct Answer:

Verified

Q67: Since corporate income taxes are levied on

Q68: The diagram below shows supply and demand

Q69: A Laffer curve

A)relates the marginal tax rate

Q70: Consider a monopolist that is earning profits

Q71: Possible implications of corporate income taxes being

Q73: In an otherwise efficient market,an excise tax

Q74: The direct burden of a tax is

Q75: The diagram below shows supply and demand

Q76: The excess burden of an excise tax

A)is

Q77: ![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents