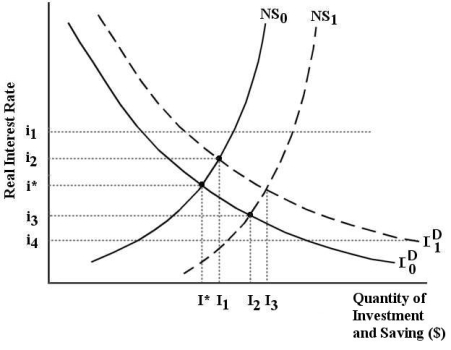

The diagram below show the market for financial capital assuming that national income is constant at potential GDP,Y*.  FIGURE 25-2

FIGURE 25-2

-Refer to Figure 25-2.Suppose national saving is reflected by NS0 and investment demand is reflected by I0D.Now suppose the government implements a revenue-neutral tax policy that encourages investment.What is the effect on the quantity of national saving?

A) There is no effect on NS or ID and the quantity of national saving supplied remains at I*.

B) National saving shifts to  ,and the quantity of national saving supplied rises to I2.

,and the quantity of national saving supplied rises to I2.

C) Investment demand shifts to I1D and the quantity of national saving supplied rises to I1.

D) Investment demand shifts to I1D,national saving shifts to NS1,and the quantity of national saving rises to I3.

E) National saving shifts to  ,investment demand shifts to I1D,and the quantity of national saving rises to

,investment demand shifts to I1D,and the quantity of national saving rises to  .

.

Correct Answer:

Verified

Q61: The Neoclassical growth model assumes that,with a

Q64: The Neoclassical growth model assumes that,with a

Q65: In the Neoclassical growth model,decreases in the

Q70: The main properties of a Neoclassical aggregate

Q73: The diagram below show the market for

Q76: The diagram below shows the market for

Q82: According to the Neoclassical growth model,which of

Q90: Consider an aggregate production function Y =

Q91: According to the Neoclassical growth model,it is

Q100: Neoclassical growth theory is based on the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents