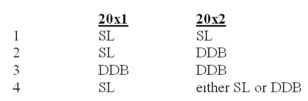

In 20x2,a firm changed from the straight-line (SL) method of depreciation to double declining balance (DDB) to conform to long-standing industry practice.The firm's 20x1 and 20x2 comparative financial statements will reflect which method or methods.

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q70: Which type of accounting change should always

Q71: Reported income during the early years of

Q72: Which of the following statements is correct?

A)

Q73: The effects for a change in accounting

Q74: Which of the following changes would be

Q76: A change in the salvage value of

Q77: A change in the estimated useful life

Q78: A change in an amortization rate,such as

Q79: If the estimated useful life of an

Q80: When an accounting change is to be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents