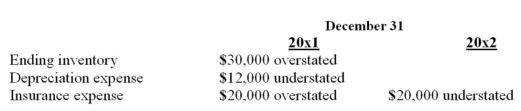

BVC began operations January 1,20x1.Financial statements for the year ended December 31,20x1,and 20x2,contained the following errors:  In addition,on December 26,20x2,fully depreciated machinery was sold for $21,600 cash,but the sale was not recorded until 20x3. There were no other errors during 20x1 or 20x2,and no corrections have been made for any of the errors.

In addition,on December 26,20x2,fully depreciated machinery was sold for $21,600 cash,but the sale was not recorded until 20x3. There were no other errors during 20x1 or 20x2,and no corrections have been made for any of the errors.

What is the total pre-tax effect of the errors on 20x2 net income?

A) $28,400 Overstated

B) $50,000 Overstated

C) $53,600 Overstated

D) $71,600 Overstated

Correct Answer:

Verified

Q77: A change in the estimated useful life

Q78: A change in an amortization rate,such as

Q79: If the estimated useful life of an

Q80: When an accounting change is to be

Q81: An asset that cost $66,000 was being

Q83: If BJC's beginning inventory in the current

Q84: Which of the following should not be

Q85: A corporation has a machine that cost

Q86: Which of the following would cause income

Q87: Which of the following is a counterbalancing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents