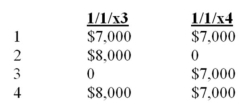

In 20x4,a firm discovered that $10,000 of equipment purchased on 1/1/x1 was expensed in full.The equipment has a ten-year life,has no residual value,and should have been depreciated on the straight-line basis.The error is corrected.As a result,the comparative 20x3 and 20x4 financial statements will show what amounts as adjustments to the beginning balances of retained earnings dated:

A) Choice 1

B) Choice 2

C) Choice 3

D) Choice 4

Correct Answer:

Verified

Q122: The records of CDF reflected the following

Q124: Listed below are a number of errors.Indicate

Q125: An asset cost $12,000 when acquired and

Q126: A firm changes from accelerated depreciation to

Q128: Which of the following combinations of errors

Q130: An asset that cost $49,500 was being

Q131: An asset cost $190,000; it is being

Q132: Depreciation expense for the most recent fiscal

Q136: An asset that cost $9,000 on January

Q148: On January 1, 2014, Ryan Ltd.purchased equipment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents