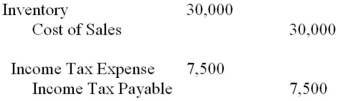

ABC Inc.'s Year 1 ending inventory was overstated by $20,000.Its Year 2 ending inventory was understated by $30,000.Assuming that the books for Year 2 are still open,which of the following adjustments would be required? Assume a tax rate of 25%.

A)

B)

C)

D)

Correct Answer:

Verified

Q124: The following accounting errors occurred in 20x1;

Q134: On January 1,Year 1,XYZ Inc.paid three years'

Q135: On January 1,Year 1,XYZ Inc.paid three years'

Q136: In 20x1,an asset was purchased for $45,000

Q137: ABC Inc.'s Year 1 ending inventory was

Q138: Ending inventory for 20x0 is overstated in

Q139: Super-Mineral began operations last year (year 1)on

Q140: On January 1,20x1,DB purchased equipment that cost

Q142: The following errors were discovered during 20x3:

Q143: The records for OTC Inc.showed the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents