ABC Inc.'s Year 1 ending inventory was overstated by $20,000.Its Year 2 ending inventory was understated by $30,000.Assuming that the books for Year 2 are now closed,which of the following adjustments would be required? Assume a tax rate of 25%.

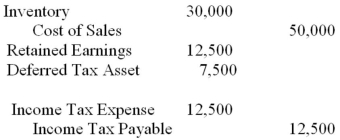

A)

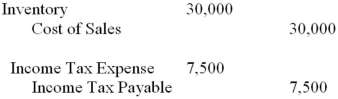

B)

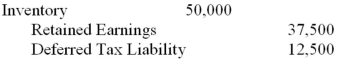

C)

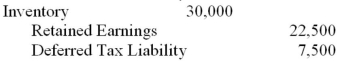

D)

Correct Answer:

Verified

Q124: The following accounting errors occurred in 20x1;

Q132: Depreciation expense for the most recent fiscal

Q134: On January 1,Year 1,XYZ Inc.paid three years'

Q135: On January 1,Year 1,XYZ Inc.paid three years'

Q136: In 20x1,an asset was purchased for $45,000

Q138: ABC Inc.'s Year 1 ending inventory was

Q138: Ending inventory for 20x0 is overstated in

Q139: Super-Mineral began operations last year (year 1)on

Q140: On January 1,20x1,DB purchased equipment that cost

Q142: The following errors were discovered during 20x3:

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents