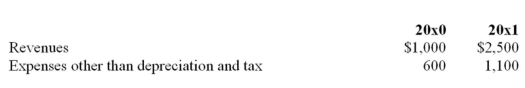

Information for a firm making an accounting change follows:  Tax rate: 30%

Tax rate: 30%

Common shares outstanding entire year for both years: 100;

Retained earnings,1/1/x0: $6,000

The firm changes from SYD to SL depreciation in 20x1 for financial

reporting purposes only.  Required:

Required:

(a)The 20x1 entries to record the accounting change and depreciation expense for 20x1.

(b)The comparative 20x0 and 20x1 income statements including pro forma disclosures if needed,EPS,and any disclosure footnote required.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q138: Ending inventory for 20x0 is overstated in

Q140: On January 1,20x1,DB purchased equipment that cost

Q142: The following errors were discovered during 20x3:

Q143: The records for OTC Inc.showed the following

Q146: AME did not account properly for the

Q147: MKC is being audited for the years

Q148: The following errors were discovered in the

Q149: Indicate how the following errors would affect

Q150: On January 1,20x1,CR purchased a special machine

Q156: On January 1, 20x3; a company purchased

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents