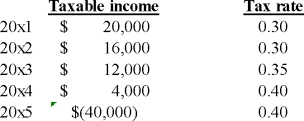

The following data represents the complete taxable income history for a firm:  What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

What is the amount of the Deferred Tax Asset - carry forward to be recognized on the 2015 statement of financial position at the end of 2015,assuming that the more likely than not criteria has been met,and that the tax rate is expected to remain at 40% for the foreseeable future?

A) $0

B) $12,000

C) $8,000

D) $3,200

Correct Answer:

Verified

Q36: The following information for KEG Corporation is

Q39: JG Corporation incurred a tax loss of

Q41: Carry back and carry forward procedures for

Q42: The following information pertains to XYZ Inc.:

Q43: Choose the best statement with respect to

Q44: The following information for KAR Corporation is

Q45: JMR Corp.sustained taxable income in 2011 of

Q46: The following information pertains to XYZ Inc.:

Q48: Once it is deemed that a potential

Q77: CCA is an optional deduction and may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents