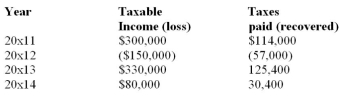

JG Ltd.has been in business for five years and incurs a loss of $520,000 in 20x15.The company has no temporary differences.The history of the company's earnings since they began operations is as follows:  The tax rate has been constant at 38%.

The tax rate has been constant at 38%.

Required:

Prepare journal entries to record the recovery of taxes and any journal entries necessary for any loss carry forwards.In 20x16,JG incurs a further loss of $40,000.The tax rate changed to 40%.Assume probability of recovery is greater than 50%.

Correct Answer:

Verified

(410,000 *.38)

(520,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: XYZ Inc.is a publicly traded company.At the

Q78: What factor would most likely cause a

Q79: The maximum number of years a tax

Q80: XYZ Ltd.,a taxable Canadian corporation,reported the following

Q83: JG Ltd.has been in business for five

Q83: How can a company use CCA to

Q85: Financial information related to Unip Limited's ("UL")2013

Q86: JG Ltd.has been in business for five

Q86: Once a deferred benefit of a tax

Q98: There is some question as to whether

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents