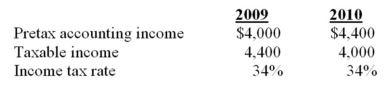

STR provided the following data related to income tax allocation:  The deferred tax account showed a zero balance at the start of 2009.There was only one temporary difference,a revenue amount,which was taxable in 2009,but was recorded for accounting purposes in 2010.There are no carry backs or carry forwards.The journal entry to record the income tax consequences for 2009 would include a:

The deferred tax account showed a zero balance at the start of 2009.There was only one temporary difference,a revenue amount,which was taxable in 2009,but was recorded for accounting purposes in 2010.There are no carry backs or carry forwards.The journal entry to record the income tax consequences for 2009 would include a:

A) Debit of $400 to STR's deferred tax account.

B) Credit of $400 to STR's deferred tax account.

C) Debit of $136 to STR's deferred tax account.

D) Credit of $136 to STR's deferred tax account.

Correct Answer:

Verified

Q51: The following data of ABC Ltd.relates to

Q52: Ryan Company paid golf dues on behalf

Q53: At most,how many deferred tax accounts will

Q54: The general terminology used to describe income

Q55: Golf dues paid for by a company

Q57: A firm reported the following in its

Q58: A deductible amount is exemplified by all

Q59: EGR just completed its first year end.During

Q60: A firm reported the following in its

Q61: EGR Corporation has one asset worth $650,000.Accumulated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents