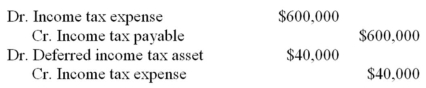

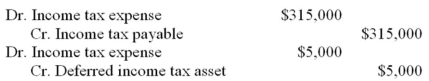

EGR Company provided you with the following information:

2013 Net Income: $1,500,000

2014 Net Income: $900,000

2013 Tax rate: 40%

2014 Tax rate: 35%

In addition,the only difference between accounting and tax are warranty costs accrued of $100,000 in 2013.No actual warranty expenses were incurred in 2013 or 2014.Prepare journal entries for 2013 and 2014 to record income tax expense.

Correct Answer:

Verified

Q99: ABC Inc.owns a single capital asset.At the

Q100: Kate Corporation sold a truck resulting in

Q105: ABC Inc.purchased new machinery for $2 million

Q105: Provide some arguments for and against the

Q108: RG Corporation has a temporary difference of

Q111: KG Company had capital assets with a

Q112: Name two conditions necessary for a deferred

Q118: Explain the income tax disclosures required under

Q120: KG Company had capital assets with a

Q122: CDE had taxable income of $7,500 during

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents