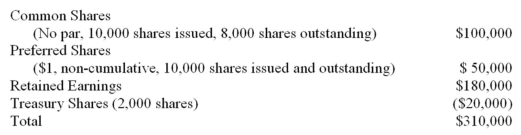

On December 31st,2011,JKL Inc.had the following account balances:

HYPERLINK "" Error! Hyperlink reference not valid.

JKL Inc.was incorporated in province allowing the existence of Treasury shares.

The company had no Accumulated Other Comprehensive Income (AOCI)balances on that date.

During 2012,the following took place:

JKL Inc.had a total Comprehensive Income of $150,000.

During 2012,JKL Inc.bought 2,000 shares of MNO Inc.for $45 per share.On December 31st,2012,these shares were trading at $60 per share.These shares,which were all on hand at the end of 2012,were designated by management as FVTOCI.These shares were the only items affecting Accumulated Other Comprehensive Income (AOCI).

Half of the treasury shares held by management at the start of 2012 were sold during the year for $15,000.

JKL declared at total of $30,000 in dividends,which included a common stock dividend valued at $10,000.

Required:

A)Prepare a Statement of Changes in Equity for JKL Inc.as per IFRS as at December 31st,2012.

B)Briefly explain how JKL Inc's reporting requirements would differ if it complied with ASPE instead of IFRS.

Correct Answer:

Verified

B)Had JKL Inc.been following ASPE,o...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q157: Lorella entered into a common share subscription

Q159: ABC made the following entry to record

Q162: During December 2019, BRC declared and issued

Q163: Explain why companies may want to reacquire

Q163: Brimley Corp.issued 5,000 common shares,no par,and 800

Q164: On January 1,2015,the accounts of CXC reflected

Q171: Several years ago, a corporation set up

Q172: Brimley Corp.issued 5,000 common shares, no par,

Q177: Explain what is meant by share issue

Q179: Propertee, Inc.declared a dividend on May 1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents