A firm issued a 16%,$1,000 bond issued and dated Jan.1/2000 maturing Jan.1,2011 paying interest each June 30 and December 31,and yielding 14%.One bond is used for simplicity.

Required:

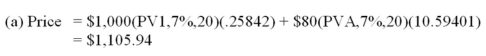

(a)Determine the price of the bond

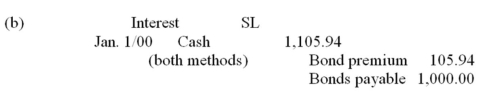

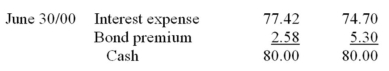

(b)All Year 2000 entries and balance sheet presentations for the bond after each interest date in Year

A. Show the interest method and straight-line methods in parallel fashion.

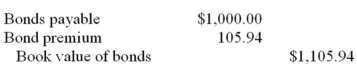

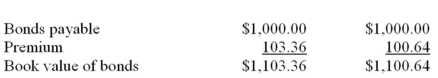

Balance sheet disclosure Jan. 1/00 (both methods)

Balance sheet disclosure Jan. 1/00 (both methods)

77.42 = $1,105.94(.07) 5.30 = $105.94/20

77.42 = $1,105.94(.07) 5.30 = $105.94/20

Balance sheet disclosure June 30/00

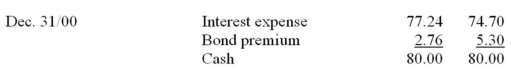

77.24 = $1,103.36(.07) 5.30 = $105.94/20

77.24 = $1,103.36(.07) 5.30 = $105.94/20

Balance sheet disclosure Dec. 31/00

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Gains or losses from the early extinguishment

Q41: Which of the following is not a

Q42: On September 1,2020,ER issued 11%,10 year bonds

Q43: ASPE and IFRS differ in their treatment

Q44: In-substance defeasance is sometimes used as a

Q46: The result of an effective interest rate

Q47: There are two methods for amortizing premiums

Q48: Which of the following is not one

Q49: On January 1,2014,ER signed a $120,000,10%,three-year,note payable.The

Q50: VB owes a $200,000,8%,five-year note payable dated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents