ABC Inc.borrowed funds from its bank.Details are as follows.

Four year term loan,U.S.$500,000

Funds borrowed 1 January 20X6; due 31 December 20X9

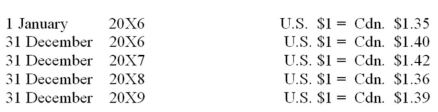

Exchange rates:  Part A: Based on the above information prepare entries to record receipt of loan proceeds for January 20X6.

Part A: Based on the above information prepare entries to record receipt of loan proceeds for January 20X6.

Part B: Based on the above information prepare entries to record the adjustment to spot rate for December 20X6.

Part C: Based on the above information prepare entries to record adjustment to spot rate December 20X7

Part D: Based on the above information prepare entries to record adjustment to spot rate December 20X8

Part E: Based on the above information prepare entries to record adjustment to spot rate December 20X9

Part F: Based on the above information prepare entries to record repayment of loan December 20X9

Part G: Based on the above information calculate the total accounting recognition of loss.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: On November 1,2009,WC purchased CX,10-year,7%,bonds with a

Q58: When the interest payment dates of a

Q60: RX issued $1,000,000,10% bonds payable (interest payable

Q61: ABC Inc.issued $10,000,000 worth of bonds on

Q61: JV issued $10,000, 10% bonds payable (interest

Q62: It is often necessary to compute the

Q65: A company wishes to finance a long-term

Q66: GHI Inc.issued $5,000,000 worth of bonds on

Q69: On September 1, 2015, a company signed

Q74: On July 1, 2012, RC sold two

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents