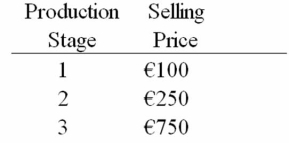

Assume that a product has the following three stages of production:  If the value-added tax (VAT) rate is 25%,what would be the VAT over all stages of production?

If the value-added tax (VAT) rate is 25%,what would be the VAT over all stages of production?

A) €187.50

B) €120

C) €150

D) €225

Correct Answer:

Verified

Q25: Which statement is false?

A)Active income is defined

Q32: Value-added tax (VAT) is

A)a direct national tax

Q34: A withholding tax is defined by your

Q34: Assume that a product has the following

Q35: The current marginal U.S. income tax rate

Q36: Assume that a product has the following

Q46: The typical approach to avoiding double taxation

Q52: A value-added tax (VAT) is _ national

Q59: The foreign tax credit method followed by

Q60: In a growing economy, the VAT would

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents