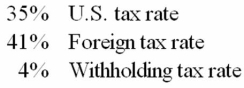

When excess tax credits go unused,the foreign tax liability for a branch is greater than the corresponding U.S.tax liability when the foreign income tax rate is greater than the U.S.rate.Calculate the total tax liability for a wholly-owned subsidiary when excess tax credits cannot be used in a country given:

A) 35.00%

B) 37.00%

C) 43.36%

D) 42.05%

Correct Answer:

Verified

Q62: A foreign branch is

A)an extension of the

Q63: When excess tax credits go unused,the foreign

Q63: An uncontrolled foreign corporation is

A)an extension of

Q64: A controlled foreign corporation (CFC) is

A)a foreign

Q67: An overseas affiliate of a U.S. MNC

Q68: A foreign subsidiary is

A)an extension of the

Q69: As a general rule,

A)excess tax credits can

Q71: The U.S. IRS allows transfer prices to

Q78: These days the benefits of "tax haven"

Q79: In a given year, the U.S. IRS

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents