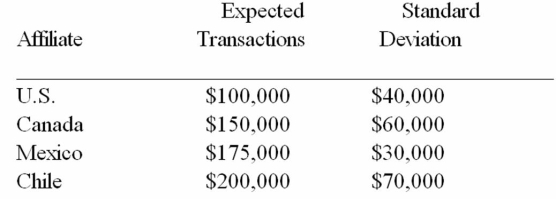

Assuming that the interaffiliate cash flows are uncorrelated with one another,calculate the standard deviation of the portfolio of cash held by the centralized depository for the following affiliate members:

A) $34,960.33

B) $139,841.33

C) $104,880.88

D) None of the above

Correct Answer:

Verified

Q21: With regard to cash management systems in

Q26: Not all countries allow MNCs the freedom

Q27: MNCs can reduce their exchange rate expense

A)by

Q28: With a CENTRALIZED CASH DEPOSITORY

A)There is less

Q33: Assuming that the interaffiliate cash flows are

Q34: The U.S.IRS allows transfer prices to be

Q35: Which of the following statements about multilateral

Q35: For a recent month,the following payments matrix

Q36: Find the net exposure of the British

Q39: The U.S.IRS allows transfer prices to be

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents