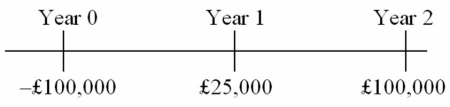

An Italian firm is considering selling its line of coin-operated cappuccino machines in the U.K.The business risk will be identical to the firm's existing line of business in the euro zone,the cost of capital in the euro zone is i€ = 10%.The expected inflation rate over the next two years in the U.K.is 3% per year and 2% per year in the euro zone.The spot exchange rates are $1.80 = £1.00 and $1.15 = €1.00. The pound sterling denominated cash flows are as follows:  What is the €-denominated NPV of this project? I did not round my intermediate steps,if you did,select the answer closest to yours.

What is the €-denominated NPV of this project? I did not round my intermediate steps,if you did,select the answer closest to yours.

A) €5,563.23

B) €2,270.79

C) €7,223.14

D) €3,554.29

E) There is not enough information (e.g.U.S.inflation) to do this problem.

Correct Answer:

Verified

Q41: What is the expected return on equity

Q42: The ABC Company,a U.S.-based MNC,plans to establish

Q42: What is CF0 in dollars?

Q48: The adjusted present value (APV) model that

Q49: As of today, the spot exchange rate

Q50: In the context of the capital budgeting

Q51: The "net present value" of a capital

Q52: Sensitivity analysis in the calculation of the

Q56: Assume that XYZ Corporation is a leveraged

Q57: The spot exchange rate is ¥125 =

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents