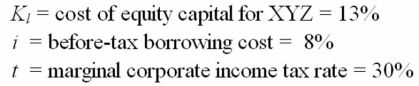

Assume that XYZ Corporation is a leveraged company with the following information:  If XYZ's debt-to-total-market-value ratio is 40%,then its weighted average cost of capital,K,is:

If XYZ's debt-to-total-market-value ratio is 40%,then its weighted average cost of capital,K,is:

A) 8%

B) 9%

C) 10%

D) 12%

Correct Answer:

Verified

Q63: For a firm confronted with a fixed

Q66: Studies suggest that international capital markets are

Q73: In the graph, Q75: Suppose that the firm's cost of capital Q76: Suppose that the British stock market is Q77: Compute the domestic country beta of Stansfield Q80: The formula for beta is: Q90: The Pricing-to-Market phenomenon Q92: With regard to the financial structure of Q96: One explanation for foreign equity ownership restrictions![]()

A)

A)describes the potential effect of

A)is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents