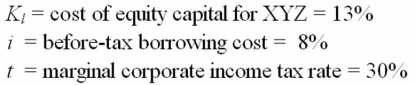

Assume that XYZ Corporation is a leveraged company with the following information:  Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

Calculate the debt-to-total-market-value ratio that would result in XYZ having a weighted average cost of capital of 9.3%.

A) 35%

B) 40%

C) 45%

D) 50%

Correct Answer:

Verified

Q41: Corporations are becoming multinational not only in

Q49: Micro Spinoffs, Inc., issued 20-year debt one

Q59: Find the debt-to-equity ratio for a firm

Q61: In the Capital Asset Pricing Model

Q64: Suppose the domestic U.S.beta of IBM is

Q65: For most countries and most firms, the

Q66: Assume that XYZ Corporation is a levered

Q72: In the real world, does the cost

Q75: The firm's tax rate is 34%. The

Q76: The following is an outline of certain

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents