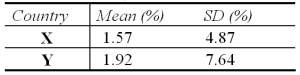

The mean and standard deviation (SD) of monthly returns,over a given period of time,for the stock markets of two countries,X and Y are  Assuming that the monthly risk-free interest rate is 0.25%,the Sharpe performance measures,SHP(X) and SHP(Y) ,and the performance ranks,respectively,for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%,the Sharpe performance measures,SHP(X) and SHP(Y) ,and the performance ranks,respectively,for X and Y are:

A) SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B) SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C) SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D) SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

Correct Answer:

Verified

Q1: Systematic risk is

A)nondiversifiable risk.

B)the risk that remains

Q7: Under the investment dollar premium system,

A)U.K. residents

Q11: A fully diversified U.S. portfolio is about

A)75

Q17: Foreign equities as a proportion of U.S.investors'

Q17: With regard to the OIP,

A)the optimal international

Q19: Systematic risk

A)is also known as non-diversifiable risk.

B)is

Q24: Emerald Energy is an oil exploration and

Q25: Bema Gold is an exploration and production

Q27: Suppose you are a euro-based investor who

Q28: Emerald Energy is an oil exploration and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents