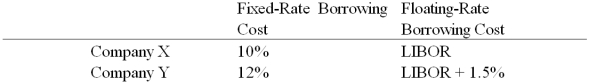

Company X wants to borrow $10,000,000 floating for 5 years.Company Y wants to borrow $10,000,000 fixed for 5 years.Their external borrowing opportunities are:  Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

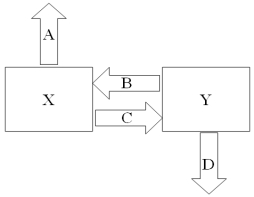

Design a mutually beneficial interest only swap for X and Y with a notational principal of $10 million by having appropriate values for A = Company X's external borrowing rate

B = Company Y's payment to X (rate)

C = Company X's payment to Y (rate)

D = Company Y's external borrowing rate

A) A = 10%; B = 11.75%; C = LIBOR - .25%; D = LIBOR + 1.5%

B) A = 10%; B = 10%; C = LIBOR - .25%; D = LIBOR + 1.5%

C) A = LIBOR; B = 10%; C = LIBOR - .25%; D = 12%

D) A = LIBOR; B = LIBOR; C = LIBOR - .25%; D = 12%

Correct Answer:

Verified

Q28: In a currency swap

A)it may be the

Q29: Swaps are said to offer market completeness

A)This

Q33: When an interest-only swap is established on

Q36: Company X wants to borrow $10,000,000 floating

Q39: Company X wants to borrow $10,000,000 floating

Q42: Floating for floating currency swaps

A)the reference rates

Q43: Consider a plain vanilla interest rate swap.

Q48: When a swap bank serves as a

Q49: Find the all-in-cost of a swap to

Q55: Some of the risks that a swap

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents