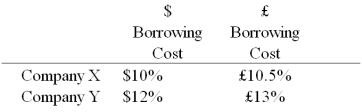

Company X wants to borrow $10,000,000 floating for 5 years; company Y wants to borrow £5,000,000 fixed for 5 years.The exchange rate is $2 = £1 and is not expected to change over the next 5 years.Their external borrowing opportunities are:  A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk

A swap bank wants to design a profitable interest-only fixed-for-fixed currency swap.In order for X and Y to be interested,they can face no exchange rate risk  What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

What must the values of A and B in the graph shown above be in order for the swap to be of interest to firms X and Y?

A) A = $10.50%; B = £12%.

B) A = $10%; B = £13%.

C) A = $12%; B = £13%.

D) A = £10.50%; B = $12%.

Correct Answer:

Verified

Q12: A swap bank has identified two companies

Q19: Company X wants to borrow $10,000,000 floating

Q22: Pricing an interest-only single currency swap after

Q23: Suppose ABC Investment Banker,Ltd.is quoting swap rates

Q25: Consider the dollar- and euro-based borrowing opportunities

Q26: A is a U.S.-based MNC with AAA

Q28: Compute the payments due in the second

Q29: Compute the payments due in the FIRST

Q37: Floating for floating currency swaps

A)the reference rates

Q39: Pricing a currency swap after inception involves

A)finding

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents