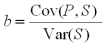

The exposure coefficient  in the regression

in the regression  informs

informs

A) how much of a foreign currency to sell forward.

B) the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

C) captures the residual part of the dollar value variability that is independent of exchange rate movements.

D) how many call options to write.

Correct Answer:

Verified

Q3: Currency risk

A)is the same as currency exposure.

B)represents

Q4: When the Mexican peso collapsed in 1994,

Q5: It is conventional to classify foreign currency

Q8: When exchange rates change,

A)U.S. firms that produce

Q10: Before you can use the hedging strategies

Q13: Operating exposure measures

A)the extent to which the

Q13: The exposure coefficient in the regression

Q16: Suppose the U.S. dollar substantially depreciates against

Q16: The exposure coefficient Q19: In recent years, the U.S. dollar has![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents