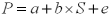

On the basis of regression Equation  we can decompose the variability of the dollar value of the asset,Var(P) ,into two separate components Var(P) = b2 *Var(S) + Var(e) The first term in the right-hand side of the equation,b2 *Var(S) represents

we can decompose the variability of the dollar value of the asset,Var(P) ,into two separate components Var(P) = b2 *Var(S) + Var(e) The first term in the right-hand side of the equation,b2 *Var(S) represents

A) the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B) captures the residual part of the dollar value variability that is independent of exchange rate movements.

C) none of the above

Correct Answer:

Verified

Q19: What does it mean to have redenominated

Q30: A U.S. firm holds an asset in

Q32: The extent to which the firm's operating

Q38: The "exposure" (i.e.the regression coefficient beta)is: Hint:

Q39: On the basis of regression Equation

Q42: Suppose a U.S.firm has an asset in

Q45: A U.S.firm holds an asset in Italy

Q49: Which of the following conclusions are correct?

A)Most

Q56: A U.S. firm holds an asset in

Q57: Suppose that you implement your hedge from

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents