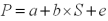

On the basis of regression Equation  we can decompose the variability of the dollar value of the asset,Var(P) ,into two separate components Var(P) = b2 *Var(S) + Var(e) The second term in the right-hand side of the equation,Var(e) represents

we can decompose the variability of the dollar value of the asset,Var(P) ,into two separate components Var(P) = b2 *Var(S) + Var(e) The second term in the right-hand side of the equation,Var(e) represents

A) the part of the variability of the dollar value of the asset that is related to random changes in the exchange rate.

B) captures the residual part of the dollar value variability that is independent of exchange rate movements.

C) none of the above

Correct Answer:

Verified

Q21: Consider a U.S. MNC who owns a

Q23: The variability of the dollar value of

Q26: A firm with a highly elastic demand

Q28: From the perspective of the U.S.firm that

Q29: With regard to operational hedging versus financial

Q30: A U.S. firm holds an asset in

Q32: Which of the following conclusions are correct?

A)Most

Q34: Operating exposure can be defined as

A)the link

Q34: In recent years,

A)the U.S. dollar has appreciated

Q36: Which of the following are identified by

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents