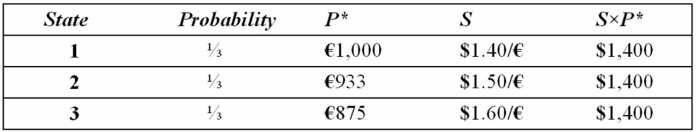

Suppose a U.S.firm has an asset in Italy whose local currency price is random.For simplicity,suppose there are only three states of the world and each state is equally likely to occur.The future local currency price of this asset (P*) as well as the future exchange rate (S) will be determined,depending on the realized state of the world.  Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€.Calculate your cash flows in each of the possible states.

Assume that you choose to "hedge" this asset by selling forward the expected value of the euro denominated cash flow at F1($/£) = $1.50/€.Calculate your cash flows in each of the possible states.

A) $1,400, $1,400, $1,400

B) $1,496.6, $1,400, $1,306.40

C) $1,404, $1,404.$1,404

D) None of the above

Correct Answer:

Verified

Q63: The firm may not be subject to

Q64: Generally speaking, when both a firm's costs

Q65: Consider a U.S.-based MNC with a wholly-owned

Q70: Which of the following is false?

A)The competitive

Q71: Generally speaking, a firm is subject to

Q72: What is the objective of managing operating

Q75: What is the objective of managing operating

Q77: Consider a U.S.-based MNC with a wholly-owned

Q78: Managing operating exposure

A)is a short-term tactical issue.

B)is

Q79: Consider a U.S. MNC with operations in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents