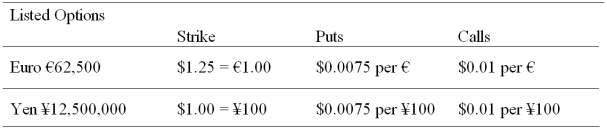

A Japanese EXPORTER has a €1,000,000 receivable due in one year. Detail a strategy using options that will eliminate exchange rate risk.

A) Buy 16 put options on euro, sell 10 call options on yen.

B) Buy 16 put options on euro, buy 10 call options on yen.

C) Sell 16 call options on euro, buy 10 put options on yen.

D) None of the above

Correct Answer:

Verified

Q43: Buying a currency option provides

A)a flexible hedge

Q51: Which of the following options strategies are

Q56: Your firm is an Italian exporter of

Q57: Your firm is a Swiss exporter of

Q59: A Japanese EXPORTER has a €1,000,000 receivable

Q72: Your U.S. firm has a £100,000 payable

Q73: Suppose that the exchange rate is €1.25

Q74: XYZ Corporation,located in the United States,has an

Q75: Suppose that the exchange rate is €1.25

Q79: To hedge a foreign currency receivable,

A)buy call

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents