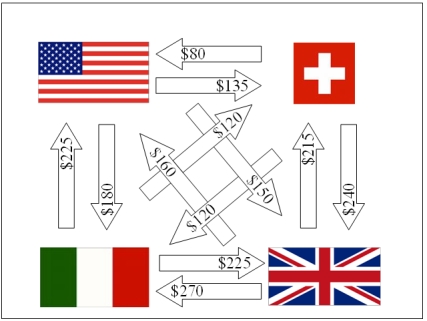

Simplify the following set of intra company cash flows for this Swiss Firm.

Consider the following exchange rates.

Correct Answer:

Verified

Step 1: Convert all cash flo...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q86: Contingent exposure can best be hedged with

A)Options.

B)Money

Q87: The current exchange rate is €1.25 =

Q87: An exporter faced with exposure to an

Q88: If a firm faces progressive tax rates,

A)they

Q88: An exporter can shift exchange rate risk

Q90: An exporter can share exchange rate risk

Q93: A study of Fortune 500 firms hedging

Q94: ABC Inc., an exporting firm, expects to

Q96: To find the swap rate for a

Q97: An exporter faced with exposure to a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents