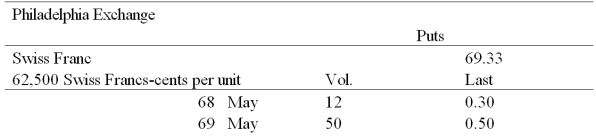

In the CURRENCY TRADING section of The Wall Street Journal,the following appeared under the heading OPTIONS:  Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

Which combination of the following statements are true? (i) - The time values of the 68 May and 69 May put options are respectively .30 cents and .50 cents.

(ii) - The 68 May put option has a lower time value (price) than the 69 May put option.

(iii) - If everything else is kept constant,the spot price and the put premium are inversely related.

(iv) - The time values of the 68 May and 69 May put options are,respectively,1.63 cents and 0.83 cents.

(v) - If everything else is kept constant,the strike price and the put premium are inversely related.

A) (i) , (ii) , and (iii)

B) (ii) , (iii) , and (iv)

C) (iii) and (iv)

D) ( iv) and (v)

Correct Answer:

Verified

Q3: What paradigm is used to define the

Q23: A European option is different from an

Q25: If you think that the dollar is

Q26: With currency futures options the underlying asset

Q29: Most exchange traded currency options

A)mature every month,with

Q33: An investor believes that the price of

Q37: The current spot exchange rate is $1.55

Q38: From the perspective of the writer of

Q39: Which of the follow options strategies are

Q39: An "option" is

A)a contract giving the seller

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents