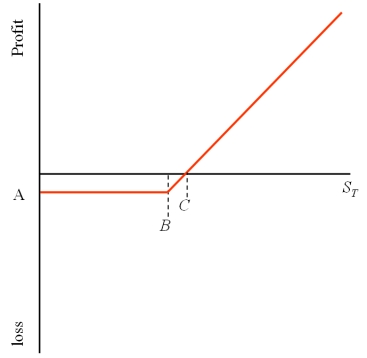

Consider the graph of a call option shown at right.The option is a three-month American call option on €62,500 with a strike price of $1.50 = €1.00 and an option premium of $3,125.What are the values of A,B,and C,respectively?

A) A = -$3,125 (or -$.05 depending on your scale) ; B = $1.50; C = $1.55

B) A = -€3,750 (or -€.06 depending on your scale) ; B = $1.50; C = $1.55

C) A = -$.05; B = $1.55; C = $1.60

D) none of the above

Correct Answer:

Verified

Q22: Exercise of a currency futures option results

Q27: The volume of OTC currency options trading

Q28: Open interest in currency futures contracts

A)tends to

Q31: The current spot exchange rate is $1.55

Q32: Which of the lines is a graph

Q32: A currency futures option amounts to a

Q33: The current spot exchange rate is $1.55

Q36: The "open interest" shown in currency futures

Q39: The current spot exchange rate is $1.55

Q51: Which of the following is correct?

A)European options

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents