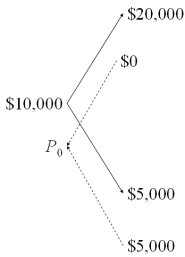

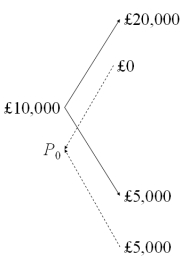

Draw the tree for a put option on $20,000 with a strike price of £10,000.The current exchange rate is £1.00 = $2.00 and in one period the dollar value of the pound will either double or be cut in half.The current interest rates are i$ = 3% and are i£ = 2%.

A)

B)

C) None of the above

Correct Answer:

Verified

Q44: Use the binomial option pricing model to

Q45: Find the value of a call option

Q49: For an American call option,A and B

Q50: The hedge ratio

A)Is the size of the

Q53: Find the hedge ratio for a put

Q53: Find the hedge ratio for a call

Q54: For European options, what of the effect

Q55: For European currency options written on euro

Q55: For European currency options written on euro

Q56: You have written a call option on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents