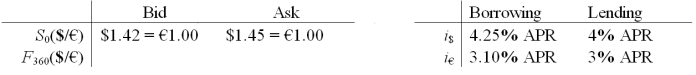

Consider a bank dealer who faces the following spot rates and interest rates.What should he set his 1-year forward ask price at?

A) $1.4324/€

B) $1.4358/€

C) $1.4662/€

D) $1.4676/€

Correct Answer:

Verified

Q25: If the annual inflation rate is 2.5

Q25: A currency dealer has good credit and

Q26: Suppose that the one-year interest rate is

Q28: Although IRP tends to hold, it may

Q30: Purchasing Power Parity (PPP) theory states that

A)the

Q32: The price of a McDonald's Big Mac

Q35: Some commodities never enter into international trade.

Q37: Generally unfavorable evidence on PPP suggests that

A)substantial

Q38: As of today,the spot exchange rate is

Q48: Forward parity states that

A)any forward premium or

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents