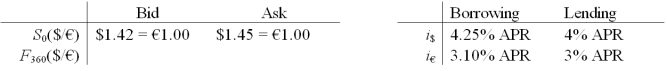

Consider a bank dealer who faces the following spot rates and interest rates.What should he set his 1-year forward bid price at?

A) $1.4324/€

B) $1.4358/€

C) $1.4662/€

D) $1.4676/€

Correct Answer:

Verified

Q1: A currency dealer has good credit and

Q19: A formal statement of IRP is

A)

Q20: When Interest Rate Parity (IRP) does not

Q21: Will an arbitrageur facing the following prices

Q22: A higher U.S.interest rate (i$

Q24: If the interest rate in the U.S.

Q27: Will an arbitrageur facing the following prices

Q33: In view of the fact that PPP

Q38: If a foreign county experiences a hyperinflation,

A)its

Q39: If IRP fails to hold

A)pressure from arbitrageurs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents