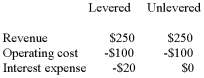

Given the following information for a levered and unlevered firm,calculate the difference in the cash flow available to investors.  Assume the corporate tax rate is 40%. (Hint:

Assume the corporate tax rate is 40%. (Hint:

Calculate the tax savings arising form the tax deductibility of interest payments) .

A) 8

B) 18

C) 78

D) 90

Correct Answer:

Verified

Q11: The option to quit a foreign project

Q12: Capital budgeting analysis is very important,because it:

A)involves,

Q13: The current spot rate between the Canadian

Q17: The ABC Company,a U.S.based MNC,plans to establish

Q17: Company X,a Canadian manufacturer of chairs,is currently

Q18: When using the adjusted present value (APV)to

Q18: The APV is calculated using the following

Q19: When making a capital budgeting decision the

Q23: (I) PV of Net Operating Cash Flows

(II)

Q47: Which of the following statements is false

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents