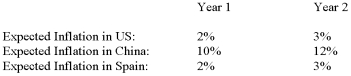

Desert Inc.is a Spanish producer of barrels and is considering the establishment of a subsidiary in China.The projected time horizon for the project is 2 years.Management wants to set up the production facilities,get them running and then sell the facilities after 2 years.The current exchange rate is renminbi 11/euro.The renminbi is pegged to the US dollar at an exchange rate of renminbi 8.28/$ and the peg is expected to stay unchanged over the next two years.The expected inflation rates for the next two years are given below:  Forecast the exchanges rates between the renminbi and the euro for the next two years.Justify your forecast.

Forecast the exchanges rates between the renminbi and the euro for the next two years.Justify your forecast.

Correct Answer:

Verified

Year 1 and 2: renminbi 11/euro...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: Company X,a Canadian manufacturer of chairs,is currently

Q17: The ABC Company,a U.S.based MNC,plans to establish

Q18: The APV is calculated using the following

Q19: When making a capital budgeting decision the

Q20: The adjusted present value (APV)model that is

Q22: White Rock Inc.located in British Columbia makes

Q23: (I) PV of Net Operating Cash Flows

(II)

Q24: Is it possible that a project has

Q26: Which cash flows are relevant for the

Q28: ABC Inc.,located in Halifax,produces towels and is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents