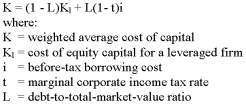

For a firm that has both debt and equity in its capital structure,its financing cost can be represented by the weighted average cost of capital that is computed by:

A) weighing the pre-tax borrowing cost of the firm and the cost of equity capital, using the debt as the weight

B) weighing the after-tax borrowing cost of the firm and the cost of equity capital, using the capital structure ratio as the weight

C)

D) b and c

Correct Answer:

Verified

Q9: The cost of capital is

A)the minimum rate

Q9: Which of the following factors is not

Q10: If XYZ's debt-to-total-market-value ratio is 40%,then its

Q11: Which of the following statements is correct?

A)

Q13: Which of the following statements is not

Q15: "When in Rome do as the Romans

Q16: Assume that the risk-free rate of return

Q17: If ABC's debt-to-equity ratio is 1: 1,then

Q20: The following is an outline of certain

Q48: Systematic risk refers to

A)the diversifiable (company specific)risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents