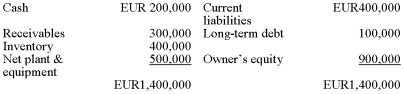

The French subsidiary of a Canadian parent has the following balance sheet (in euros):  The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the temporal method,what happened to the total value of assets?

The euro increases in value from EUR 1.6/C$ to EUR 1.3/C$.Using the temporal method,what happened to the total value of assets?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Translation exposure is defined as:

A) the sensitivity

Q15: Under the current rate method

A)All balance sheet

Q16: The "reporting currency" is:

A)the currency of the

Q17: Translation exposure refers to:

A)accounting exposure

B)the effect that

Q19: The net effect of an increase in

Q20: A Canadian firm has an integrated foreign

Q23: The French subsidiary of a Canadian parent

Q23: Explain the differences between an integrated foreign

Q26: Explain the major differences between translating financial

Q28: Assume that translation or transaction exposure cannot

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents