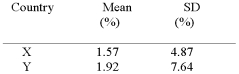

The mean and standard deviation (SD) of monthly returns,over a given period of time,for the stock markets of two countries,X and Y are  Assuming that the monthly risk-free interest rate is 0.25%,t he Sharpe performance measures,SHP(X) and SHP(Y) ,and the performance ranks,respectively,for X and Y are:

Assuming that the monthly risk-free interest rate is 0.25%,t he Sharpe performance measures,SHP(X) and SHP(Y) ,and the performance ranks,respectively,for X and Y are:

A) SHP(X) = 0.271, rank = 1, and SHP(Y) = 0.219, rank = 2

B) SHP(X) = 0.271, rank = 2, and SHP(Y) = 0.219, rank = 1

C) SHP(X) = 18.84, rank = 1, and SHP(Y) = 23.04, rank = 2

D) SHP(X) = 23.04, rank = 2, and SHP(Y) = 18.84, rank = 1

Correct Answer:

Verified

Q4: Which of the following characterizes international investor

Q7: If the investor had sold £5,the principal

Q9: Calculate the exchange rate return from a

Q10: Calculate the investor's annual percentage rate of

Q11: Investors can use of the following to

Q14: The "Sharpe performance measure" (SHP)is:

A)a "risk-adjusted" performance

Q16: To evaluate the gains from holding international

Q17: Calculate the investor's annual percentage rate of

Q23: The realized dollar returns for a U.S.resident

Q40: Exchange rate fluctuations contribute to the risk

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents